Moody's Investors Service says that Indiabulls Real Estate B1 corporate family ratings (CFR) with a stable outlook remain unchanged, despite its weak credit metrics, because the ratings incorporate the company's commitment to reduce borrowings through asset sales, cash equity injections by the promoter, and improvements in cash flows from operations.

Moody's Investors Service says that Indiabulls Real Estate B1 corporate family ratings (CFR) with a stable outlook remain unchanged, despite its weak credit metrics, because the ratings incorporate the company's commitment to reduce borrowings through asset sales, cash equity injections by the promoter, and improvements in cash flows from operations.

Indiabulls' credit metrics remain weakly positioned for its ratings with Moody's-adjusted EBITDA to interest at 1.7x - for the six months ended September 2015 - while the threshold for the ratings is 2.0x.

Indiabulls' credit metrics remain weakly positioned for its ratings with Moody's-adjusted EBITDA to interest at 1.7x - for the six months ended September 2015 - while the threshold for the ratings is 2.0x.

However, Indiabulls' borrowings fell to Rs 58.6 billion as of Sept. 30, 2015 from Rs 65.4 billion as of the fiscal year ended March 2015 (FY2015).

The company has committed to further reduce its debt by Rs 3.5 billion by March 2016 and a further Rs 15 billion in FY2017.

The operating performance of the company was weak in FY2015, but it has started improving in FY2016.

During FY2015, the company managed sales of only Rs 20.4 billion (1.8 million square feet or msf), as against Moody's expectation of Rs 25-30 billion (3-4 msf).

For the six months ended September 2015, the company achieved sales of Rs 15.6 billion.

However, the improvement in operating sales has yet to be reflected in the company's cash flows as collections have not improved as significantly.

The company made collections of Rs 5.8 billion in 1HFY2016 against Rs 9.6 billion in FY2015.

"The ratings will come under pressure unless there is a substantial improvement in cash flow from operations and assets sales, such that borrowings fall in line with our expectations," says Vikas Halan a Moody's vice president and senior credit officer.

Most of the sales in 1H FY2016 came from the company's projects in Mumbai, with Indiabulls Blu, Indiabulls Green, Panvel and Indiabulls Golf City, Savroli contributing towards majority of the sales.

"The ratings also incorporate our expectation that the company will start generating sales from its projects in Gurgaon, near Delhi", adds Halan, also Moody's lead analyst for Indiabulls.

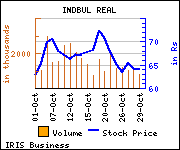

Shares of the company gained Rs 0.8, or 1.25%, to trade at Rs 65.05. The total volume of shares traded was 245,357 at the BSE (12.23 p.m., Friday).